At least £4.5 billion of port investment in infrastructure and assets between 2020 and 2025

£6 billion invested in wider port estates

Use the map to learn more about some of our members’ projects.

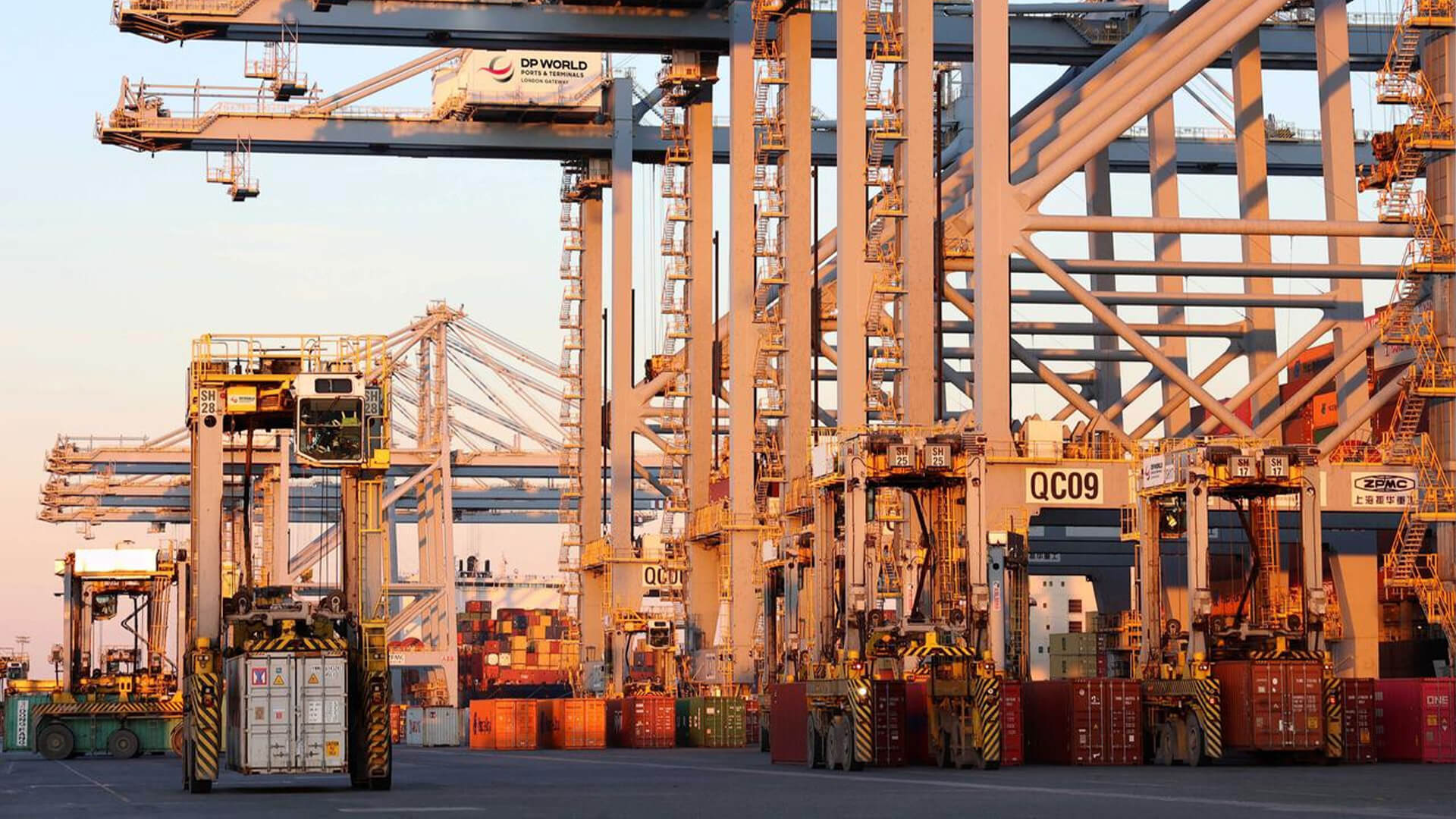

Ports across the UK are reinvesting in their own estates, buying new cranes, extending terminals, modernising their operations, and cutting emissions.

Since 2020, at least £4.5 billion of private capital has been invested in hundreds of projects and new technologies at UK ports* – from major berth extensions, to small but vital upgrades to port infrastructure.

This is private capital that ports are willing to spend at scale to keep trade moving, facilitate future growth opportunities, and support the transition to net zero. These are tangible upgrades that add capacity, resilience and jobs.

Ports are buying kit, extending capacity and electrifying operations so the UK can move more, faster, and cleaner. This is happening everywhere: offshore wind hubs in Scotland, new container capacity on the Humber, and upgrading the cruise passenger experience on the South coast. Together, these projects add up to a sector that is modernising at pace.

£200m investment, ongoing to 2025. ABP and Stena Line are building a brand new freight ferry terminal at Immingham, expanding RoRo capacity on the Humber and strengthening the UK’s busiest port complex.

£90m dual-purpose quay under construction. The deepwater facility will host some of the world’s largest cruise ships while doubling as an assembly hub for offshore wind, reinforcing Belfast’s role as a trust port reinvesting in the city and region.

£400m redevelopment of a former oil and gas yard into a 450-acre offshore wind hub. Backed by global investors, the site will provide manufacturing, assembly and marshalling for ScotWind projects, with Phase 1 operational in 2025.

This is private capital flowing into critical national infrastructure. They are backing themselves by committing billions of pounds to stay competitive for decades to come.

Explore the BPA’s map of port investments below to learn more about how the industry is preparing.

*Figures come from BPA’s project-level dataset of verified port investments. They differ from ONS “harbour construction orders” (c. £9bn over the same period) because that series tracks orders placed with contractors, not confirmed outturn spend. BPA project-level dataset aggregates verified, named port projects, actual spend committed on estates, terminals and equipment. Both show the same story: heavy, sustained investment in UK ports.

Use the map to learn more about some of our members’ projects.

Get more information contact form for the Investment Showcase page.

"*" indicates required fields